Net Zero is the most significant change project that humanity has seen in modern times and perhaps of all time.

What does Net Zero mean?

We should remember that there isn’t a standard definition of what “net-zero emissions” means with no agreed means of enforcing it. So by 2050, could we have many Net Zero companies and Net Zero investment portfolios while the economy engulfs the planet in an overwhelming heat blanket?

The EU Taxonomy is a new regulatory innovation in sustainable finance to address this problem. But will the innovation put us on the trajectory towards Net Zero?

I had the opportunity to address this question at the recent Environment Ireland Conference.

Speakers at the Environment Ireland Conference

What is the EU Taxonomy?

Responding to the environmental crisis, the EU developed a system of rules and guidelines to accelerate the Net Zero transition. The overall package is called the European Green Deal.

To achieve its environmental goals, the EU wants investors to direct capital to “green” projects, assets and companies while addressing greenwashing claims for so-called “sustainable” financial products.

The EU Taxonomy is an essential part of the Green Deal.

It is a green classification system for investments that qualify as sustainable, and it aims to scale up the supply of credibly sustainable financial assets.

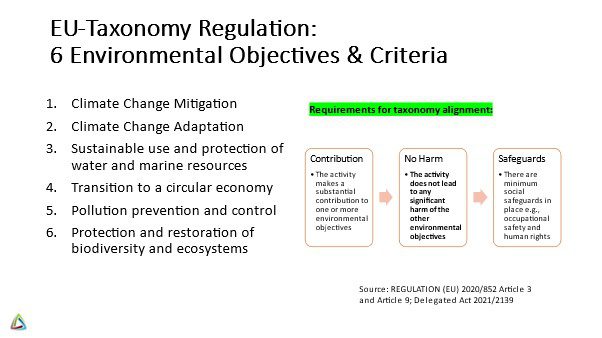

Economic activities defined as ‘environmentally sustainable, are those which: “make a substantial contribution to at least one of the EU’s climate and environmental objectives, while at the same time not significantly harming any of these objectives while meeting minimum social safeguards.”

EU Taxonomy in a Nutshell

How does it work?

The EU Taxonomy regulation applies to companies subject to non-financial reporting obligations. Currently, this means publically listed companies. From 2025, the Corporate Sustainability Reporting Directive (CSRD) will expand the remit of the EU Taxonomy to all EU companies meeting at least two of the following criteria:

- at least 250 employees

- annual turnover exceeding €40m

- assets exceeding €20m.

This means that obligated companies will be reporting the extent to which their economic activity (turnover, CAPEX and OPEX) is Taxonomy aligned or “green”. Investors, banks and other stakeholders will use this information to guide their decision-making about asset allocation. The EU’s big bet is that companies with higher levels of taxonomy alignment will be viewed favourably and attract a lower capital cost. Companies with a lower cost of capital should grow faster, displacing those activities with low alignment. The Theory of Change is that the outcome will be a Net Zero EU by 2050.

The Net Zero effect

The EU Taxonomy will provide the basis for developing sustainable finance tools, including Ecolabels for retail financial products and standards for EU green bonds.

It is assumed that companies with economic activities with little or no room to reduce their emissions to levels in line with Net Zero by 2050 will need to find ways to manage their transition (gradually switching to more sustainable economic activities) to avoid cliff-edge effects on the company, its workers, investors and other stakeholders.

EU Taxonomy – “potential blind spots.”

However, what if all of our efforts in sustainable finance are doing more harm than good? Why might this be? Arguably, our efforts fuel a feelgood bandwagon led by bankers, publicists, lawyers, consultants (like me), companies and countries selling the vision that something substantial is happening to save the climate. Meanwhile, global GHG emissions remain stubbornly unimpressed by well-intentioned initiatives and keep increasing remorselessly.

What do we need from Sustainable Finance and ESG to achieve Net Zero?

We need much deeper integration between financial and non-financial reporting to achieve Net Zero. For example, if you want to look at the value of buildings, you will rely on financial statements showing the building’s profitability. However, the building owner is not required to report on the investment needed to defend the property against future sea-level rises or the cost of CO2 emissions that have gone into the construction of the building and its current operation. Instead, ESG and non-financial reporting catalogue the risks without deducting their costs from profitability.

However, all this is minor in comparison with ESG’s biggest failing. ESG is all about disclosing and reporting information – which is different to doing something. Environmental damage must be quantified and accounted for. Damaging the environment and polluting free of charge cannot just be a matter of disclosing and reporting.

Executive compensation needs to be based on these adjusted earnings to align incentives with what is going on in the real world.

Will the EU Taxonomy work for a Net Zero world?

EU Taxonomy seeks to encourage divestment from unsustainable investments. However, divestment only works if another investor buys the assets of the divesting investor. Divestment might be a good risk management strategy for a company or a fund manager. However, divestment is not an effective strategy for creating an actual outcome.

In other words, divesting is an excellent way to decarbonise a portfolio, but divestment does not decarbonise the economy. The wrong Theory of Change leads to a probable outcome of a significant impact on the financial sector but a minimal effect on the climate.

Share this on...